Of the 5,000 odd manufacturing units, 200 had shut down by September. Most of the others have reduced production and working hours.

Diamond traders and brokers sit idle at the diamond trading hub of Mini Bazaar, Surat, awaiting a revival.

As is well known, Surat is the global centre of the diamond cutting and polishing industry. Around 90 per cent of the 'rough' diamonds mined across the world are sent to Surat. In particular, Surat enjoys a complete monopoly on the smaller and cheaper demands, where the value addition by cutting and polishing is the greatest. It is also the second largest diamond trading hub in India, after Mumbai. More than 800,000 people in this city of 4.5 million are involved in this Rs 80,000-crore industry - as 'manufacturers' or 'diamantaires' (as owners of cutting and polishing units are called), as workers in the diamantaires' units, wholesalers, traders, brokers, retailers and jewelry fabricators.

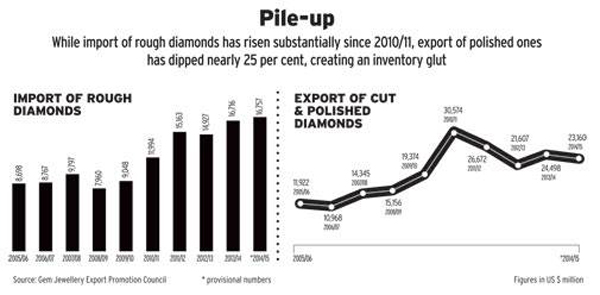

Of the 5,000 odd manufacturing units, 200 had shut down by September. The problem is not confined to Surat. Miles away, at the Bharat Diamond Bourse (BDB) in Mumbai, which houses offices of around 2,500 diamond related businesses, including that of the Mumbai Diamond Merchants Association, the mood is somber. Inventories have piled up in Mumbai and Surat. The compound annual growth rate (CAGR) of the industry from 2009 to 2014 stands at six per cent for polished diamonds and five per cent for diamond jewelry. India imported roughs worth $16,757 million in 2014/15 and exported cut and polished diamonds of $23,160 million.

So what explains the paradox? Two main reasons are cited. First, in recent years, Indian manufacturers misjudged the potential of the market. Paul Rowley, Executive Vice President, Global Sightholder Sales at De Beers, the world's largest miner of rough diamonds, agrees: "People in the midstream and downstream (manufacturers and retailers) were growing too quickly, which did not match consumer demand." Banks readily went along with the manufacturers' mistaken estimate, providing the capital for large diamond imports. The second major reason is that market growth, though continuing, has not been as rapid lately as it was before, especially in China and India. Like Indian manufacturers, Chinese retailers too appear to have misjudged the market. A number of major jewellery chains in Greater China (including Hong Kong and Macau) went on an expansion drive from 2011. This year, with sales in Hong Kong and Macau falling 24 per cent and overall by six per cent, several stores are expected to shut.

Two other factors, which may well wreak further havoc in future, have added to the woes of Indian diamond merchants. The first is the depreciation of the rupee and, in recent times, the devaluation of the Chinese yuan as well. The second is the large scale infiltration of synthetic diamonds, or chemical vapour deposition (CVD) diamonds as they are called, so artfully created that even experts find it difficult to tell them apart from the natural ones.

Not only are the miners holding prices, they have largely even stopped the generic advertising they used to engage in, such as De Beers' 'A Diamond Is Forever campaign'. "There is growing angst in the community that the miners who make the maximum profits in the supply chain are not spending much to try and revive the demand," says Shah of GJEPC. Top miners led by De Beers and ALROSA have recently formed an association to drive consumer demand, but whether its efforts will make a difference remains to be seen.