Alcoa generated adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $483 million in 2Q17, compared to $533 million in 1Q17. Lower alumina prices were the key driver of Alcoa’s lower 2Q17 EBITDA.

Alcoa (AA) reported its 2Q17 financial results on July 19 after the markets closed. The company reported revenues of $2.86 billion in 2Q17 versus $2.66 billion in 1Q17 and $2.32 billion in 2Q16. While Alcoa’s 2Q17 revenues rose on a sequential basis as well as yearly, its profits fell from 1Q17. Alcoa generated adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $483 million in 2Q17, compared to $533 million in 1Q17. Lower alumina prices were the key driver of Alcoa’s lower 2Q17 EBITDA.

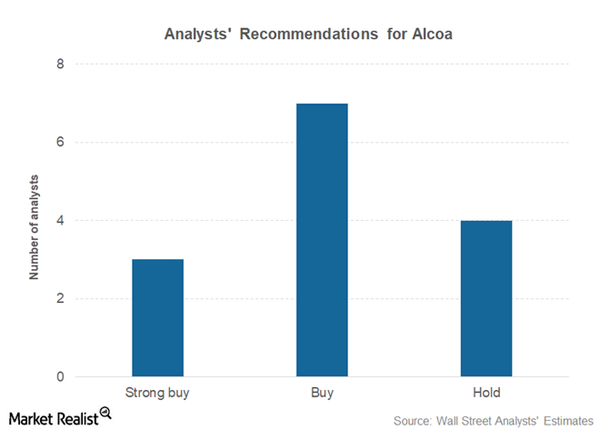

Analysts’ recommendations

According to consensus estimates compiled by Thomson Reuters, Alcoa carries a mean one-year price target of $43.75, which represents 13.3% upside over its closing price on August 9. In contrast, the stock carried a one-year target price of $43.73 on July 18—one day before its earnings release. There have been no major changes in Alcoa’s ratings since the company’s 2Q17 earnings release. However, on July 21, Berenberg raised Alcoa’s price target from $40 to $41.

Company guidance

While Alcoa managed to post better-than-expected earnings in 2Q17, the company gave a profit warning on higher input costs. Other producers, including Century Aluminum (CENX) and Norsk Hydro (NHYDY), also face rising input costs—especially carbon prices (XLB).

During their 2Q17 earnings call, Alcoa gave 2017 adjusted EBITDA guidance between $2.1 billion and $2.2 billion. The guidance assumes constant foreign currency exchange rates and physical aluminum premiums. During their 1Q17 earnings call, Alcoa said that it expects to generate adjusted EBITDA between $2.1 billion and $2.3 billion this year. Essentially, the company has tightened its 2017 EBITDA guidance.