We saw a divergence in aluminum and alumina prices in 2Q17. While aluminum prices largely held their ground in the quarter, we saw a weakness in alumina prices. This divergence could reflect in Alcoa’s 2Q17 earnings.

Alcoa’s 2Q17 earnings

According to consensus estimates compiled by Thomson Reuters, Alcoa (AA) is expected to post revenues of $2.87 billion in 2Q17. To put this in context, it posted revenues of $2.65 billion in 1Q17. We don’t have the financial data for the corresponding period last year due to Alcoa’s split.

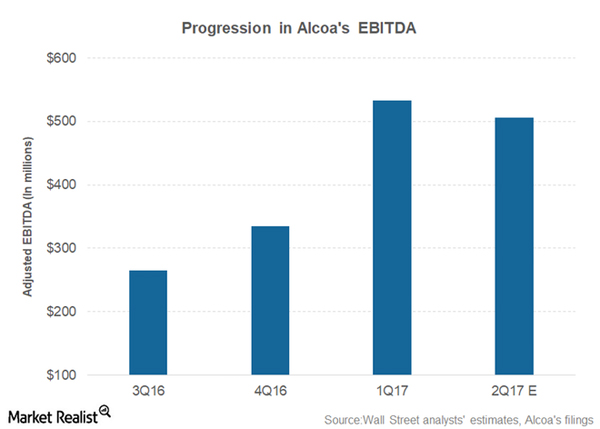

While analysts expect Alcoa’s 2Q17 revenues to rise on a sequential basis, they see the company posting lower EBITDA (earnings before interest, tax, depreciation, and amortization) for the quarter. Analysts polled by Thomson Reuters expect Alcoa to post EBITDA of $506.0 million in 2Q17 compared to $533.0 million in 1Q17.

Key drivers

We saw a divergence in aluminum and alumina prices in 2Q17. While aluminum prices largely held their ground in the quarter, we saw a weakness in alumina prices. This divergence could reflect in Alcoa’s 2Q17 earnings. The company’s alumina operations could report lower profits in 2Q17, while the profitability for its aluminum operations could rise on higher aluminum prices. However, lower alumina prices could more than offset higher alumina prices due to the steep fall in the API (alumina price index).

We should remember that integrated aluminum producers such as Alcoa, Rio Tinto (RIO), and Norsk Hydro (NHYDY) are negatively impacted when alumina prices fall. However, Century Aluminum (CENX) stands to gain from lower alumina prices since it buys alumina from outside parties.