Aluminum production requires raw materials. Alumina and electricity are the key inputs that go into aluminum production. Historically, alumina has been priced as a percentage of aluminum prices. Over the last few years, producers have been turning to...

Lower alumina prices

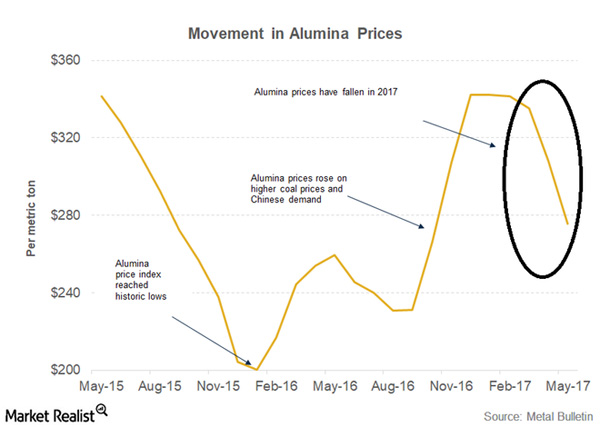

Aluminum production requires raw materials. Alumina and electricity are the key inputs that go into aluminum production. Historically, alumina has been priced as a percentage of aluminum prices. Over the last few years, producers have been turning to the API (alumina price index), which helps in alumina’s individual price discovery.

Integrated companies

Alcoa (AA), like Norsk Hydro (NHYDY) and Rio Tinto (RIO), is an integrated aluminum producer. It has alumina refining as well as aluminum smelting operations. Notably, API prices were strong last year. Capacity curtailments in China and higher thermal coal prices helped buoy alumina market sentiments. Alcoa gained from higher alumina prices. The company’s Alumina segment posted a sharp increase in profitability.

However, API prices have fallen significantly this year, as you can see in the above graph. The decline in alumina prices is a concern for Alcoa. First, the profitability of its alumina operations would be hit due to lower alumina prices. Second, falling alumina prices could also pressure aluminum prices. Smelters that buy alumina from third parties (CENX) could increase their production to maximize their profitability. So far, falling alumina prices haven’t had a major impact on aluminum prices (DBB). If alumina prices stay at lower levels, it could impact aluminum prices.

Final word

While aluminum has managed to hold on to some of its 2017 gains, rising geopolitical tensions, lower alumina prices, and concerns about Chinese capacity curtailments could dampen aluminum sentiments in the near term.