During its 1Q17 earnings call, Alcoa (AA) guided for adjusted EBITDA1 between $2.1 billion–$2.3 billion in fiscal 2017. This guidance assumes current foreign currency exchange rates and physical aluminum premiums.

Alcoa’s 2017 earnings

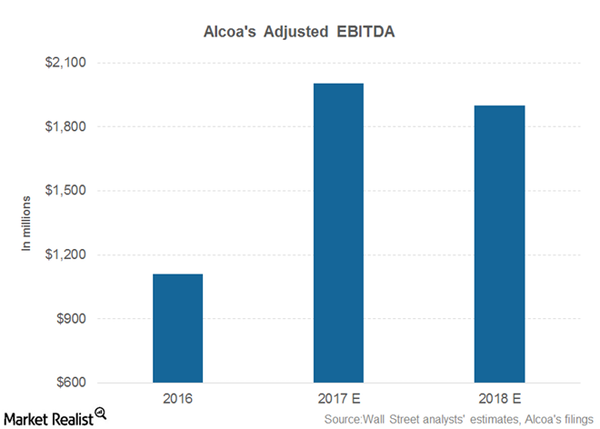

During its 1Q17 earnings call, Alcoa (AA) guided for adjusted EBITDA1 between $2.1 billion–$2.3 billion in fiscal 2017. This guidance assumes current foreign currency exchange rates and physical aluminum premiums.

In arriving at this guidance, Alcoa assumed aluminum prices of $1,900 per metric ton and an API (alumina price index) of $305 per metric ton.

While Alcoa kept its 2017 EBITDA guidance unchanged from its 4Q16 earnings call, it changed its metal price assumption in arriving at this guidance. Notably, Alcoa raised its assumption of aluminum prices from $1,795 per metric ton to $1,900 per metric ton, while slashing its API assumption from $355 per metric ton to $305 per metric ton.

Analysts’ estimates

While alumina prices have come off their 2017 highs, aluminum has managed to hold its ground. According to consensus earnings estimates compiled by Thomson Reuters, analysts expect Alcoa to deliver EBITDA of ~$2.0 billion this year.

Analysts’ estimates are based on expected average commodity prices rather than prevailing commodity prices (CENX) (RIO). Some market observers expect aluminum prices to weaken this year, fearing the rally has taken prices too far. Analysts seem to be pricing in a correction in aluminum prices as they determine Alcoa’s earnings estimates.

What’s priced in?

Alcoa’s valuation multiples suggest that markets don’t expect a further upside in aluminum prices (NHYDY) (SOUHY). The stock currently trades at a forward EV-to-EBITDA2 of 4.5x, which appears to be on the lower side when considering midcycle valuation multiples.