According to the research study, the synthetic diamonds market is expected to witness a rise of close to 100% in the next eight years, ending up at US$28.8 bn by 2023.

According to the research study, the global synthetic diamond market was worth US$15.7 bn in 2014. Driven by the lower cost of synthetic diamonds in comparison with natural diamonds and the rise in the number of industrial applications of synthetic diamonds, the market is expected to witness a rise of close to 100% in the next eight years, ending up at US$28.8 bn by 2023.

Synthetic diamonds are also called cultured or cultivated diamonds. These demonstrate characteristics similar to natural diamonds. However, they can be manufactured at a comparatively low cost, while properties of synthetic diamonds can be modified as per requirements of end-user industries. These are produced by using HPHT (High Pressure High Temperature) or CVD (Chemical Vapor Deposition) in the laboratory. Synthetic diamonds are widely used in end-user industries such as jewelry, mining and construction, electronics, and healthcare. These are also increasingly used as coating and in machine tool industries.

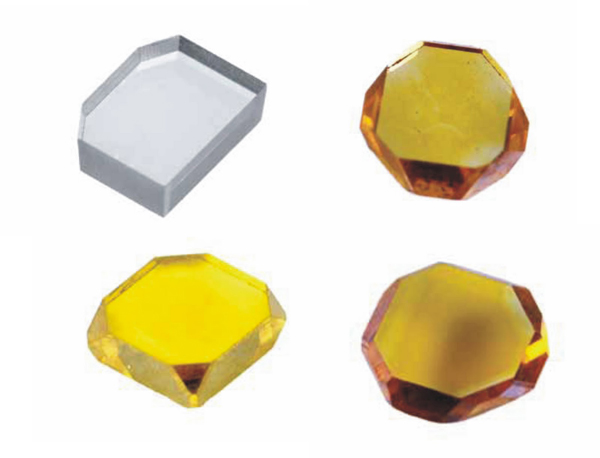

Synthetic diamonds can be further classified based on type into polished and rough diamonds. Polished diamonds are primarily used as gemstone in jewelry and are produced in a variety of colors such as red, yellow, purple, blue, pink, green, as well as colorless. Cost of synthetic diamond is based on cut, clarity, color, and carat. Rough synthetic diamond is the major type of synthetic diamond with its strong presence in the industrial diamond segment. On the basis of product type, synthetic diamonds are divided into bort, grit, dust, powder, and stone segments.

Construction and mining and electronics are major end-user segments of the synthetic diamond market. Synthetic diamonds can be used in milling, grinding, cutting, drilling, and polishing as an abrasive owing to physical properties such as high rigidity. These diamonds depict good electrical and thermal properties; hence they are used in electronics as material for making wafer substrate and conductors. Synthetic diamonds exhibit chemical, optical, and thermal characteristics. This has resulted in its growing usage in the electronics end-user segment. In terms of revenue, polished diamond accounted for majority of the market share in 2014. The stone segment is the key product segment of the synthetic diamond market. Synthetic diamond powder and grit are employed in machine tools such as saws, grinding wheels, and impregnated bits. Diamond bort is primarily utilized for polishing (as grain abrasive) and drill bits. Chemical Vapor Deposition (CVD) is a less complex but costlier manufacturing process as compared to High Pressure High Temperature (HPHT) process, which is widely used to produce synthetic diamond.

Growing environmental concern regarding the mining process that is carried out for exploring natural diamonds coupled with strict governmental regulations to extract natural diamond is likely to hamper the production of natural diamonds, thereby giving rise to the manufacture of synthetic diamond. Asia Pacific was the largest market for synthetic diamond due to increase in end-use applications in the region in 2014. The region accounted for more than 50% of the global synthetic diamond market in 2014. Demand for synthetic diamond in the region is estimated to be primarily driven by rapid upsurge in mining in China, India, and countries in ASEAN. Middle East and Africa was the fastest-growing synthetic diamond market due to increased usage of synthetic diamond in construction activities. Europe experienced comparatively sluggish growth in 2014 due to impact of the economic crisis. The synthetic diamond market in Latin America is also expected to experience decent growth during the forecast period due to recovery of the region from financial crisis.

Growing end-users of synthetic diamonds coupled with low cost of synthetic diamond in comparison to natural diamond is estimated to drive the synthetic diamond market during the forecast period. Furthermore, rising demand for synthetic diamond in various applications is projected to act as a major opportunity for the synthetic diamond market in the near future. Research and development is being done to determine a simple process for manufacturing synthetic diamond. Key players in the synthetic diamond market are Element Six, Applied Diamond Inc., Scio Diamond Technology Corporation, Tomei Diamond Co., Ltd., Pure Grown Diamonds, New Diamond Technology, LLC, Washington Diamonds Corporation, Centaurus Technologies, Inc., Crystallume, Sandvik AB, and ILJIN. The synthetic diamond market is highly consolidated; the top three manufacturers accounted for majority of the market share in 2014.