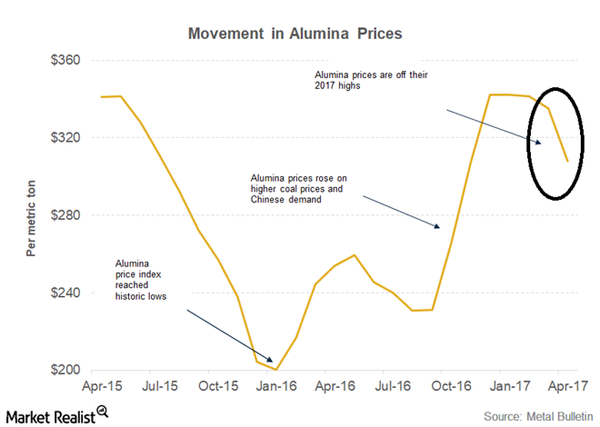

Alumina prices have weakened over the last two months. Today, we’ll see what lower alumina prices mean for Alcoa (AA) and other producers. We’ll also see how lower alumina prices could impact aluminum markets.

Alumina prices have weakened over the last two months. Today, we’ll see what lower alumina prices mean for Alcoa (AA) and other producers. We’ll also see how lower alumina prices could impact aluminum markets.

Impact on producers

Rio Tinto (RIO), Norsk Hydro (NHYDY), and Alcoa (AA) all have alumina refining as well as aluminum smelting operations. However, Century Aluminum (CENX) produces aluminum by sourcing alumina from outside parties. Lower alumina prices would hurt Alcoa and Rio Tinto’s earnings. Their alumina operations could report lower earnings due to falling alumina prices (DBB).

Impact on aluminum price

While alumina prices weakened, aluminum prices showed strength in the last few months. Alumina prices, as a percentage of aluminum prices, have fallen. Although lower alumina prices might not immediately lead to a decline in aluminum prices, they certainly could limit aluminum’s upside.

We should remember that one of the factors that supported aluminum’s upward price action was the rising trend in alumina prices. As input costs rose, especially for coal and alumina, aluminum prices got a natural boost.

Now, we’re seeing an unwinding of some of the factors that led to the spike in aluminum prices. Some of China’s curtailed aluminum capacity seems to have come back online. The capacity is visible in the country’s production data. Also, alumina prices have pared some of their recent gains.

Looking at the above argument, in our view, aluminum’s upside could be limited in 2Q17. The lightweight metal could have a hard time breaching the $2,000 per metric ton level.