We’ve seen strength in aluminum and alumina prices in the past few months. Alcoa’s earnings are sensitive to aluminum and alumina prices (RIO) (XME). Alcoa expects its annual EBITDA to rise by $226 million for every $100 per-metric-ton rise in

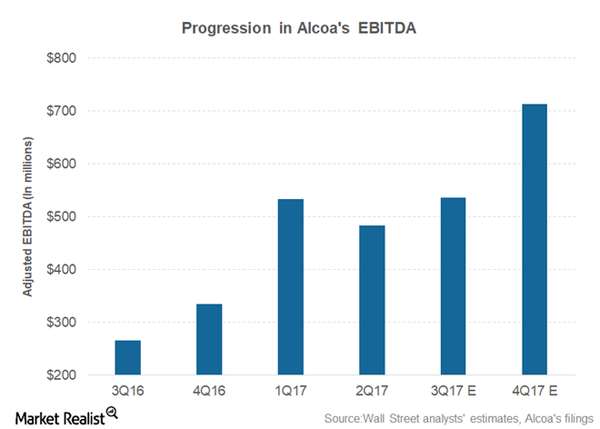

According to consensus estimates compiled by Thomson Reuters, Alcoa (AA) is expected to post an adjusted EBITDA of $536 million in 3Q17—compared to $483 million in 2Q17 and $265 million in 3Q16. While Alcoa’s 3Q17 EBITDA is expected to rise in 3Q17 compared to previous quarters, analysts see even better days ahead for the company. They expect Alcoa’s EBITDA to rise to $713 million in 4Q17.

Metal prices

Notably, we’ve seen strength in aluminum and alumina prices in the past few months. Alcoa’s earnings are sensitive to aluminum and alumina prices (RIO) (XME). Alcoa expects its annual EBITDA to rise by $226 million for every $100 per-metric-ton rise in aluminum prices. Looking at alumina, Alcoa’s 2017 EBITDA is expected to rise or fall by $69 million for every $10-per-metric-ton increase or decrease in the alumina price index.

Currently, aluminum prices are trading above $2,100 per metric ton, while alumina is quoted near multiyear highs. Both of these commodities are much higher compared to the average prices in 3Q17. The full impact of higher commodity prices could be visible in Alcoa’s 4Q17 earnings—assuming that we don’t see a major pullback in aluminum and alumina prices in the coming months.