Pre-tax profits at industrial diamond manufacturer, Element Six, last year more than doubled to $86.48m (€78.7m).The Shannon-based firm recorded the sharp increase in pre-tax profits in spite of revenues plummeting by more than $100m

Pre-tax profits at industrial diamond manufacturer, Element Six, last year more than doubled to $86.48m (€78.7m).

The Shannon-based firm recorded the sharp increase in pre-tax profits in spite of revenues plummeting by more than $100m from $332.3m to $228.2m.

According to the directors' report "the main challenges of 2015 were dealing with the sharp downturn in the oil and gas sector which impacted significantly on our revenues and managing the impact of foreign currency fluctuations on our business".

"We have focused on tight cost control and increasing market share to mitigate its impact," said the directors.

The firm's pre-tax profits increased by 105pc going from $42m to $86.48m.

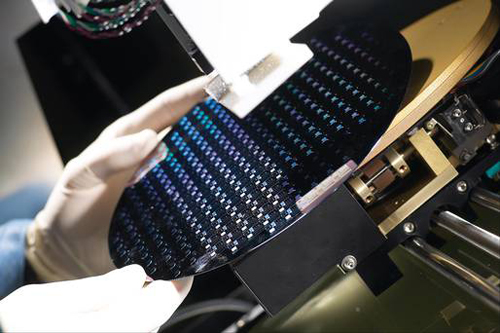

The firm further cemented its future at Shannon in 2015 with Element Six announcing a €25m capital investment at the facility involving the establishment of a diamond synthesis facility at its Co Clare site.

According to the directors "this new facility came on stream in quarter four, 2015 and involved a significant additional capital investment in the site's production facilities in 2015".

"The Element Six group continues to invest in research and development into new products and technologies and it is hoped that these will yield increased market share and market growth," they added.

The new investment involved the creation of 40 new jobs at the Shannon plant.

Overall, numbers employed by Element Six Ltd reduced from 410 to 393.

This is made up of 290 in production; 77 in administration and finance; 18 in engineering and sales and marketing totalling eight.

This was from a base of 250 people employed after the introduction of a survival plan at the plant in 2009.

That plan involved the redundancy of 207 workers.

Staff costs last year reduced sharply going down from $36.67m to $26.9m.

The profit last year takes account of hefty non-cash depreciation and amortisation costs totalling €12.69m.