De Beers,the world’s largest diamond supplier,reports that business has slowed since the Indian government pulled R500- and Rs1,000-denomination notes out of circulation.It’s another unintended effect of the demonetization,which is meant to weed out count

Bain & Co. predicts that by 2020, India will surpass Europe and Japan to become the world’s third-largest market for diamond jewelry, trailing only the US and China. But first, a speed-bump.

De Beers, the world’s largest diamond supplier, reports that business has slowed since the Indian government pulled R500- and Rs1,000-denomination notes out of circulation. It’s another unintended effect of the demonetization, which is meant to weed out counterfeiting, tax evasion, and black-market activity.

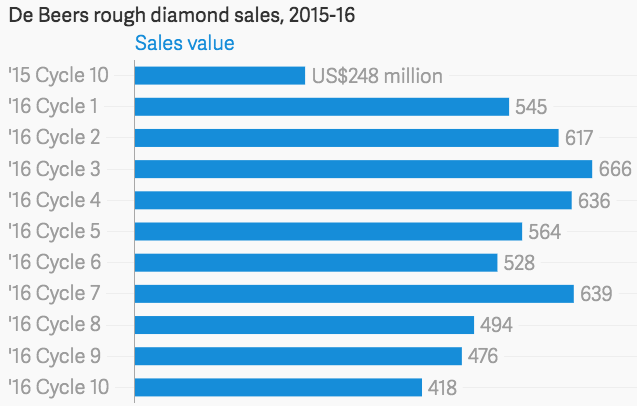

Anglo American, a majority stakeholder in De Beers, said that rough diamond sales in the final cycle of 2016—it divides the year into 10 sales cycles—amounted to $418 million, down from $476 million in the previous cycle. (That was still up from the final cycle of 2015, when a slowdown in China pinched sales.)

Indians tend to purchase jewelry in cash and most of the country does not have credit cards—and for those who do, the ATM withdrawal limits are too low to purchase precious gems.

In recent years, India has come to be a hotbed for diamond manufacturing. Surat, one of India’s major diamond hubs in the state of Gujarat, polishes nearly 80% of the world’s diamonds. But demand for the gems has declining globally since 2011—and demonetization in a key market could make matters worse. The diamond industry’s reliance on paper money means traders are facing delayed payments from clients and jewelers are in turn unable to pay their staff. Other industries like agriculture are encountering similar challenges.

To battle the cash crunch and subsequent drop-off in demand, De Beers reportedly eased restrictions on buyers in India, giving them the option, for example, to refuse lower-quality stones from pre-mixed assortments, according to Bloomberg. Incentives like these are rare. But the effect wasn’t strong enough to offset the impact of demonetization.