A small team of scientists working for De Beers is scrambling to stave off a looming threat that could tarnish the luster of natural-mined diamonds: high-quality man-made stones.

A small team of scientists working for De Beers is scrambling to stave off a looming threat that could tarnish the luster of natural-mined diamonds: high-quality man-made stones.

In the past few years, lab-grown diamonds have become indistinguishable from natural diamonds to the naked eye and are growing in sales. While still a small fraction of the market, synthetic gems could account for nearly one-tenth of rough-diamond sales within five years, according to Morgan Stanley estimates.

Made by a small group of private companies as well as giants such as De Beers itself, man-made diamonds could undermine the value of the entire diamond industry, some experts say. These diamonds have the same chemical and physical properties as their natural counterparts. They sparkle like mined stones, are hard and durable enough for intense industrial purposes and—perhaps most important—can be marketed without any hint at their provenance.

Infinite quantities of man-made diamonds could be theoretically produced, upending a market that depends on a perception of relative scarcity to secure premium prices.

De Beers has created an array of devices that diamond wholesalers and jewelry makers can use to detect them.

“A concern is the risk that you buy the necklace that your wife wanted and discover it’s not the real thing,” De Beers strategy chief Gareth Mostyn said.

Containing the risk of lab-grown diamonds is crucial for De Beers owner Anglo American PLC. The London mining giant is getting rid of assets in its coal and iron-ore units to focus on more profitable businesses, such as diamonds. De Beers accounted for 42% of Anglo’s earnings before interest, taxes and exceptional items in the first half of 2016.

For now, lab-grown-diamond production remains tiny compared with stones dug from the ground. Synthetic producers can make 250,000 carats to 350,000 carats of rough diamonds annually, according to industry estimates, compared with about 135 million rough carats mined every year.

Martin Roscheisen, chief executive of Diamond Foundry Inc., a San Francisco synthetic-diamond producer with a capacity of 24,000 carats, said he believes nearly all diamonds consumers purchase will be man-made in a few decades.

Swarovski Group, the closely held Austrian luxury-products seller, launched its own man-made diamond jewelry line in April.

Morgan Stanley analyst Menno Sanderse doesn’t expect synthetic diamonds to ever displace a big chunk of global output, but he wrote in July that lab-grown gems had become “a serious potential disrupter.”

Des Kilalea, a mining analyst at RBC Capital Markets, said consumers might gravitate toward the synthetic stones, which are currently about 20% to 30% cheaper than natural diamonds on average. The capital costs involved in producing a lab-grown diamond are only slightly lower than mining a diamond.

At a plant about 30 miles west of London, De Beers scientists have been working to detect synthetic diamonds for years. The company has its own synthetic-diamond facility, called Element Six, which produces synthetic diamonds for industrial purposes, such as drilling, and helps De Beers keep up with technological developments.

The man-made stones are developed using a diamond from the ground or another synthetic diamond that acts as a seed to grow more gems. Gases of carbon material are employed at extremely high temperatures to grow new crystals over several weeks.

Simon Lawson, head of De Beers’ U.K. technologies division, said his biggest concern is tiny diamonds—less than one-fifth of a carat—which are too costly to screen in an effective manner given their size and value.

That makes it easier for the lab-grown variety to get into the supply chain and possibly end up in jewelry marketed as natural.

In 2015, a package containing 110 man-made diamonds being passed off as natural stones was intercepted in India, according to the Times of India, citing the Surat Diamond Association.

To counter the threat, last year De Beers helped launch a trade association with other producers to market the attraction of natural diamonds. It also started marketing a new, cheap detector that quickly screens tiny synthetic diamonds.

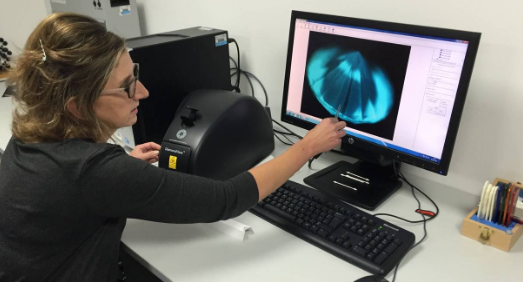

The device, called PhosView, costs $4,500—far less than the $35,000 it charges for its DiamondView instrument, which uses ultraviolet light to detect lab-grown stones. With the flip of a switch, the PhosView device illuminates a batch of diamonds in a pan. Stones are revealed as synthetic when they show a strong phosphorescent glow—a reaction rarely seen in natural diamonds.

De Beers made 50 of the machines for jewelry makers, and they sold out quickly, the company said.

Ferreting out synthetic diamonds will be important for the industry, as an attraction of a mined diamond remains “that it comes from deep from Mother Earth,” said Russell Shor, a senior analyst at the Gemological Institute for America.

“They’re billions of years old,” he said. “It’s probably the oldest thing we can buy.”