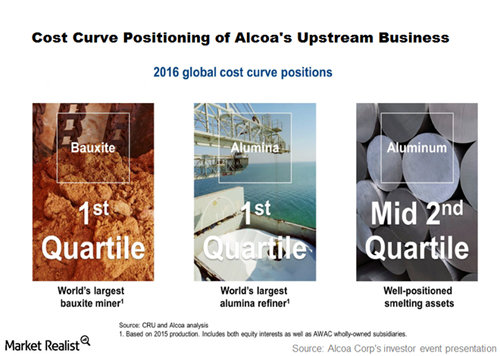

Alcoa (AA) has been proactive in controlling its costs to stay competitive in the subdued commodity pricing environment. While Alcoa has a decent position on the bauxite and alumina cost curves, the company’s aluminum operations were relatively high-cost.

Alcoa (AA) has been proactive in controlling its costs to stay competitive in the subdued commodity pricing environment. While Alcoa has a decent position on the bauxite and alumina cost curves, the company’s aluminum operations were relatively high-cost.

However, Alcoa’s aluminum operations have now moved to the 38th percentile from the 51st percentile eight years ago due to curtailments of high-cost capacities. Alcoa’s cost positioning in bauxite and alumina is compelling. The company sits in the first quartile of the global cost curve in both of these businesses.

Integrated producer

Alcoa also has a portfolio of casthouses, power generation capacity, and rolling mills. Integrated operations make Alcoa one of the few listed pure-play aluminum producers. Notably, most of the top aluminum producers are Chinese companies (ACH). Among other major producers, Rio Tinto (RIO) is a major aluminum producer. The company is mainly an iron ore play. Century Aluminum (CENX) doesn’t have an upstream business. Norsk Hydro (NHYDY) is one of the few publicly traded integrated aluminum producers.

Scarcity premium for Alcoa?

US investors have few options to play the aluminum industry. Solely based on being a pure-play integrated aluminum producer, Alcoa could command a scarcity premium. However, would investors pay a premium to play the aluminum space that’s saddled with massive Chinese overcapacity? You can explore more about China’s overcapacity problem in Aluminum Supply: Chronic Overcapacity Is Here to Stay.

Although aluminum markets might be off their troughs, we might not see a quick turnaround soon.