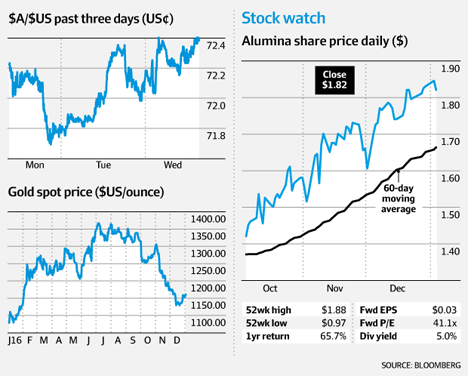

Shares in Alumina dropped 1.6 per cent to $1.82 after the company outlined the size of the hit it will take from charges related to its AWAC joint venture's closure of an alumina refinery and bauxite mines in Suriname as well as an impairment of interest.

Stock Watch

Shares in Alumina dropped 1.6 per cent to $1.82 after the company outlined the size of the hit it will take from charges related to its AWAC joint venture's closure of an alumina refinery and bauxite mines in Suriname as well as an impairment of interest in a Western Australia gas field. The recently announced closure of the Suriname operations - a joint venture between Alcoa and Alumina - will result in total restructuring-related charges of $108 million and related cash costs of $181 million over five years from 2017. Alumina said its share of the charges and costs will be $43 million and $72 million respectively, while it will bear another $21 million of a $52 million charge related to the Perth basin gas field impairment.

Investors lost some of their new year exuberance on Wednesday sending the ASX only marginally higher, as gains in financials and Telstra offset losses in the energy and utilities sectors.

The benchmark S&P/ASX 200 Index and the broader All Ordinaries Index each closed up 0.06 per cent to 5736.4 points and 5788.2 points respectively.

A global equity rally has extended into the new year, boosted by positive economic data out of the US, China and Europe that has painted a rosier picture for global growth.

However, investors are turning wary of the recent record highs attained on Wall Street and the buoyant ASX, which hit a 2016 high just before Christmas, as the January 20 inauguration of President-elect Donald Trump looms.

"Markets have been rallying quite strongly on this notion of fiscal hope but, as we move into the reality of 2017 and what a Trump presidency will actually look like, there is some risk of fiscal disappointment," said Paul Eitelman, strategist at Russell Investments.

Joint venture interest in bauxite mining, alumina refining, alumina based chemicals and aluminium smelting via its 40 per cent interest in the series of operating entities of Alcoa World Alumina & Chemicals (AWAC).

"Any disappointment at this point could be a source of downside risk for markets from here, so we're incrementally being a bit more cautious."

A slight tumble in the iron ore price weighed on Rio Tinto, which closed down 0.9 per cent, while BHP Billiton and Fortescue Metals found buying support, closing up 0.6 per cent and 1.7 per cent respectively.

There was broad-based buying in the big four banks, which all closed up between 0.5 and 0.9 per cent. Investors also piled into Telstra, boosting the stock 0.4 per cent.

Gold was trading marginally higher on Wednesday, but a strong finish on Tuesday night was enough to prompt some buying support for the likes of Newcest Mining, Australia's largest gold producer, which closed up 0.8 per cent and Evolution Mining, which bumped up 1.4 per cent.

The price of Brent crude traded slightly higher to fetch $US55.86 a barrel in late trade on Wednesday, though this didn't flow through to energy stocks, which the sector finishing the day 0.1 per cent lower.

Investors rotated out of industrial stocks and consumer staples, forcing Woolworths and main rival Wesfarmers, owner of Coles, to close down 0.08 per cent and 0.6 per cent respectively.

There was little equities news around to stimulate investors, however Hunter Hall's share price slipped another 2.8 per cent, following Tuesday's 19 per cent drop, after the company established an independent board committee to consider a takeover bid from investment firm Washington H Soul Pattinson.

WHSP is offering $1 per Hunter Hall share, which values the target at about $27.3 million.

Market Movers

Gold

Gold came off a three-week high as the $US further strengthened and investors exited some gold exchange traded funds. The price of the precious metal was moderately higher in the afternoon, up 0.1 per cent to $US1160.5 an ounce after closing at $US1158 an ounce the previous session, its highest since December 12. Investors are closely watching the movements of the US Federal Reserve which has flagged three more interest rate hikes in 2017, which could limit the upside for bullion.

Australian dollar

Positive Chinese and Australian manufacturing data combined with a modest uptick in commodity prices have provided support for the Australian dollar against the greenback. The Aussie was fetching US72.37¢ in late afternoon trade. However the recent selloff in the Chinese yuan poses downside risks for the Aussie, says Kathy Lien, managing director of FX strategy at BT Asset Management. "We still believe that the weakness of China's currency will come back to haunt Australia's economy," she wrote in a client note.

Oil

Brent crude bumped up 0.7 per cent to $US55.86 a barrel ahead of US government data expected to show US inventories probably dropped by 2.25 million barrels last week, according to a Bloomberg survey. OPEC and other oil producing nations have also begun trimming their output levels in a bid to stabilise oil prices. OPEC member Kuwait has cut output by 130,000 barrels a day from the official start date of the deal on January 1, while Oman is curbing supply by 45,000 barrels a day this month.

Asian shares

Shares around the region climbed on Wednesday after positive US manufacturing data boosted confidence and traders in Japan returned from holidays to a weakened yen. The Japanese currency has extended its retreat for a fourth day. South Korean shares traded largely sideways while investors send Hong Kong's exchange down. Investors seem to be shaking off suggestions that Trump's fiscal policies might have unintended consequences for the world's largest economy and would contribute to global instability.