Alcoa expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017, as compared to 13.2 million metric tons in fiscal 2016. Alumina prices have shown resilience so far, which should be positive for Alcoa’s 1Q17 profitab

Before we analyze alumina markets, let’s look at aluminum’s value chain. It starts with mining bauxite—one of the most abundant metals in the Earth’s crust. Due to bauxite’s many impurities, it must be refined to produce alumina. This alumina is then processed to produce raw aluminum (SOUHY).

Rio Tinto (RIO), Norsk Hydro (NHYDY), and Alcoa (AA) all have alumina refining as well as aluminum smelting operations. However, Century Aluminum (CENX) produces aluminum by sourcing alumina from outside parties.

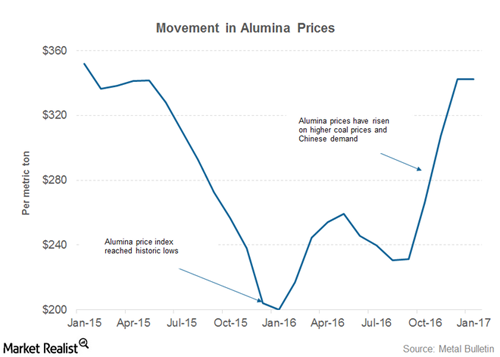

Prices rose in 4Q16

Alumina prices have been stable in 2017 after the big surge in 4Q16. Higher alumina prices were a key driver of Alcoa’s 4Q16 profitability. Alcoa reported an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $355 million in 4Q16, as compared to $284 million in 3Q16. The bauxite and alumina segments contributed the most to Alcoa’s 4Q16 profitability, generating $102 million and $167 million of EBITDA, respectively, that quarter.

2017 guidance

Alcoa expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017, as compared to 13.2 million metric tons in fiscal 2016. Alumina prices have shown resilience so far, which should be positive for Alcoa’s 1Q17 profitability.

However, Shelly Harrison, Century Aluminum’s Senior Vice President, sounded bearish on aluminum prices. During the company’s 4Q16 earnings call, Harrison stated: “We are anticipating downward pressure on the alumina price near term in reaction to Chinese refinery restart and startup in 2016 and early 2017.”